- Intentional Dollar

- Posts

- Exploring engineered optionality, champion mentality, and rearranging things

Exploring engineered optionality, champion mentality, and rearranging things

Exploring engineered optionality, champion mentality, and rearranging things

Happy Thursday! Thanks for reading Intentional Dollar — where we look at old money ideas through a new perspective.

What’s inside?

One idea to experiment with

Two quotes from others

Three questions to dig deeper

Four lines of poetry for the point

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

One idea to experiment with:

Engineered Optionality:

Are you saving too much for retirement?

It sounds like a strange question, doesn’t it?

Too much in a retirement account? Isn’t that the goal?

Actually, saving too much for retirement is not only possible, it’s common.

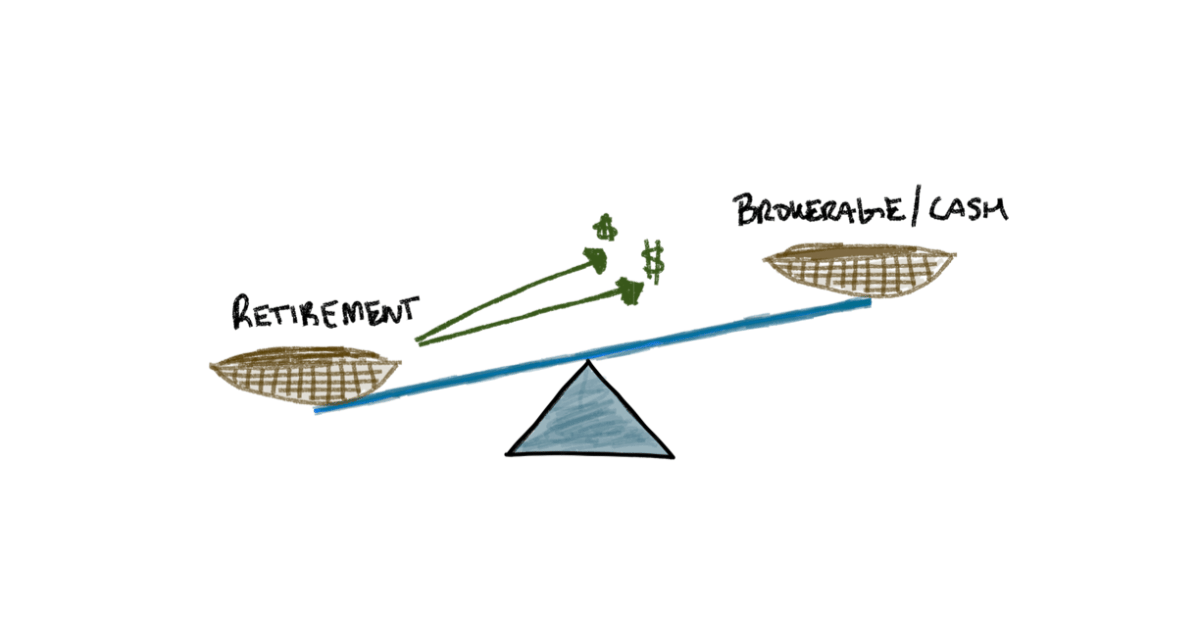

When all your savings funnel into tax-deferred retirement accounts, your financial life becomes unbalanced. The tax advantages feel smart in the short run, but the long-term tradeoff is less flexibility, less liquidity, and potentially a pile of taxable risk later on.

Retirement accounts are intentionally illiquid. They’re designed so you can’t access your money easily. Sure, there are loans, hardship withdrawals, and a few exceptions. Those are band-aids to an illiquidity problem. In reality, your money is locked away until age 59½, and touching it early often triggers taxes and penalties./2 , and touching it early often triggers taxes and penalties.

The risk isn’t just about early access. It’s about having too much money trapped in tax-deferred accounts, where every future withdrawal could be taxed at higher rates, and where you have little control over timing or flexibility. Meanwhile, you’ve shortchanged other accounts that give you freedom.

I’ve seen it too often: people overfund their 401(k)s and IRAs, feeling responsible and disciplined, but end up with small pools of money outside of retirement plans. They’re retirement rich and optionality poor.

The smarter goal isn’t to maximize retirement savings.

It’s to maximize flexibility, or engineer life optionality. Thats what cash is. Thats what money in a brokerage account is. Engineered optionality. Building wealth across different tax buckets and timelines, so you have control over your money both before and after retirement.

All financial people will say too much cash is a bad thing. They’ll say cash drag, opportunity cost, those kinds of things. But cash and brokerage assets give you options, and options are good.

If you want to retire early, or take a sabbatical, or take a lower paying job, you need the flexibility to do so. Too much in retirement will gate your ability to make the moves you want to make from now to 59½.

What’s the composition of your net worth? How liquid are you? How much optionality are you engineering along the way?

do you have the right asset mix?

Two quotes on champion mentality:

What are the winners doing?

“Champions behave like champions before they’re champions; they have a winning standard of performance before they are winners.”

“Winning is not a sometime thing; it’s an all-the-time thing. You don’t win once in a while — you don’t do things right once in a while — you do them right all the time.”

Three questions on rearranging things:

When’s the last time I rearranged things to get a new perspective?

What if the things fit, but the current location doesn’t?

What new solutions are illuminated from the new layout?

Which question stuck with you? Questions like these are spotlights for the mind. Reply to this email and let me know which one shined light on a previously dark cave.

Four lines of poetry for the point:

Saving isn’t saving

When accounts aren’t the same

Illiquidity with a premium

Might be the wrong game

Contact Me:

Content ideas, questions? Reply to this email or reach out to me at [email protected]

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

The Simplest Way to Create and Launch AI Agents and Apps

You know that AI can help you automate your work, but you just don't know how to get started.

With Lindy, you can build AI agents and apps in minutes simply by describing what you want in plain English.

From inbound lead qualification to AI-powered customer support and full-blown apps, Lindy has hundreds of agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy automate workflows, save time, and grow your business.

Reply