- Intentional Dollar

- Posts

- Exploring mental accounting, health, and changing how I do things

Exploring mental accounting, health, and changing how I do things

Exploring mental accounting, health, and changing how I do things

Happy Thursday! Thanks for reading Intentional Dollar — where we look at old money ideas through a new perspective.

What’s inside?

One idea to experiment with

Two quotes from others

Three questions to dig deeper

Four lines of poetry for the point

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

One idea to experiment with:

Mental Accounting

The other day, I spent more money than I needed to on a pair of glasses. I didn’t intend to buy them—but justified the expense through a bout of mental accounting.

Let me explain.

Each year, I schedule an eye exam. I go in, do the whole “better one, better two?” barrage, take the abrasive puffs of air to the eyes, get my prescription, order a new supply of contacts, and go on my way. If my prescription changes, I’ll usually go home and order a cheap pair of glasses online.

I didn’t do that this year. I deviated.

Normally, when the salesperson tries to hook me into trying on frames, I (politely) decline. But this visit, I opted for a “sure.”

A few sample pairs were brought out. I tried them on. Asked for the cheapest options. But by then, I’d been pulled too far into the sales funnel to escape. Before I knew it, I had bought the glasses.

As I walked out of the store, I was both amazed and analytical.

Amazed at how quickly and unexpectedly I’d abandoned my plan.

Analytical about how I’d rationalized the spend.

After turning it over in my mind, I realized: mental accounting was to blame.

I had bucketed my HSA funds into a separate pool of “free money” for health expenses. Spending from that account—especially with enough cash available—didn’t feel like spending at all.

And that’s the danger.

Mental accounting distorts our sense of value. The fact that money sits in a separate account shouldn’t change how easily we part with it.

A large 529 doesn’t justify frivolous college spending.

A tax refund isn’t a bonus check for luxury goods.

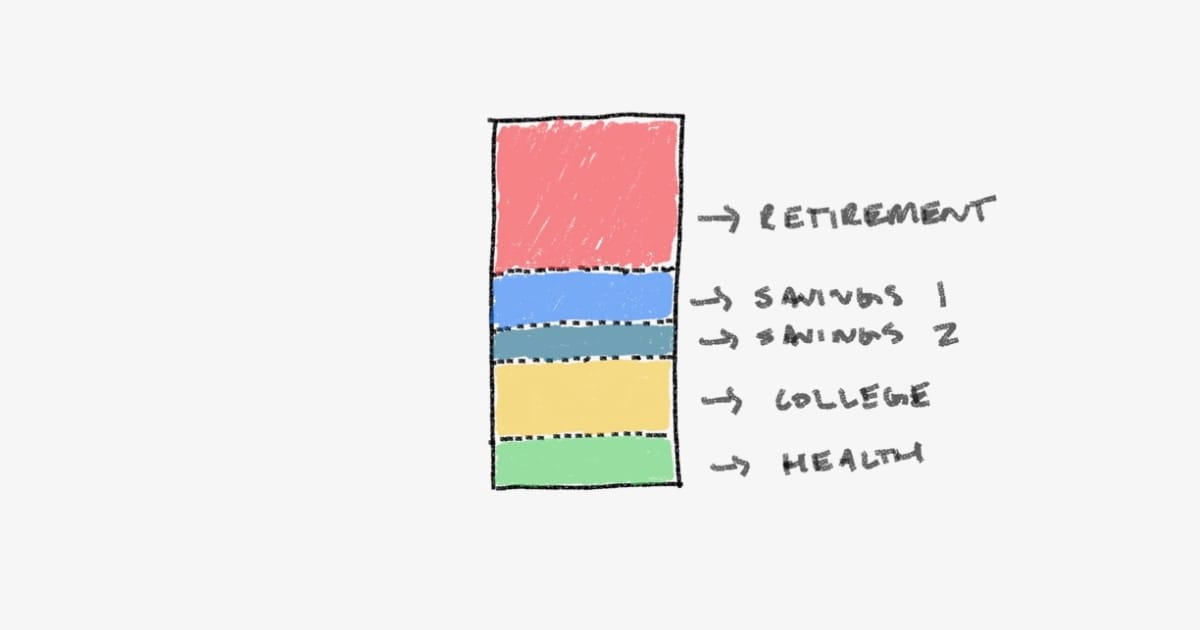

Having separate high-yield accounts for a car, a vacation, a house, and an emergency fund doesn’t change your total cash position.

An HSA shouldn’t greenlight luxury health expenses that would otherwise be gated.

Money is fungible.

Having separate accounts for different purposes can be extremely valuable. Mental accounting, in that sense, isn’t all bad—it can help us organize priorities, automate discipline, and reduce decision fatigue.

But it becomes dangerous when the dollars slip away more easily simply because they feel different.

The problem isn’t the labeling—it’s the illusion that spending from one bucket is somehow less costly than spending from another. That illusion gives us permission. It lowers our guard. And before we know it, we’re making decisions we wouldn’t have made if the money had come from somewhere else.

Even if an account is earmarked for qualified expenses, that doesn’t make the dollars in it any less real—or any less yours.

Pulling $100 from an HSA is still pulling $100 from your net worth.

That’s still your money. Even if it’s tucked away in a specially labeled jar.

The truth is, I wouldn’t have made the purchase if I’d needed to pull out a credit card, write a check, or hand over cash. That would have felt heavier.

But this?

This was “health money,” not “real money.”

So my radar missed it.

Are the glasses nice? Sure.

Are they six times nicer than the pair I would’ve bought online? Absolutely not.

Where has mental accounting seeped into your own life—your spending, your saving, your justifications? And what purchases would you have second-guessed if the money had come from your main account?

separate accounts shouldn’t be spent any looser

Two quotes on health:

Health is wealth. Think of how much money the richest person in the world would give away to get healthy should they become gravely ill. They’d give away all of it.

“Nothing has a greater effect on your ability to enjoy experiences—at any age—than your health. In fact, health is actually a lot more valuable than money, because no amount of money can ever make up for very poor health—whereas people in good health but with little money can still have many wonderful experiences.”

“Health is not valued till sickness comes.”

Three questions on changing how I do things:

I like reading books, but have less free time—what about listening to them?

Where in my old routines would new efficiencies and new technologies improve my outcomes?

What kind of slippage, switching cost, or other friction results from the change — do my gains eclipse this?

Which question stuck with you? Questions like these are spotlights for the mind. Reply to this email and let me know which one shined light on a previously dark cave.

Four lines of poetry for the point:

A dollar there doesn’t feel the same

It’s from a separate account with a separate name

But all is yours under one roof

Mental accounting tries to hide that proof

Contact Me:

Content ideas, questions? Reply to this email or reach out to me at [email protected]

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

Get a List of the Best HRIS Software for Your Company

Stop wasting time on endless research and confusing options.

Our HR Software experts provide you with tailored recommendations from our database of 1,000+ vendors across HRIS, ATS, Payroll, and HCM.

✅ 15 minutes vs. hours of demos

✅ 1:1 help from an HR Software expert

✅ No spam, no sales pressure

Reply