- Intentional Dollar

- Posts

- Exploring trampolines and land mines, uniqueness, and past mistakes

Exploring trampolines and land mines, uniqueness, and past mistakes

Exploring trampolines and land mines, uniqueness, and past mistakes

Welcome to the Intentional Dollar weekly newsletter — great work taking this small step to move your money forward. I’m Logan, a Certified Financial Planner™, and I’m excited you’re here!

What’s inside?

One tool to experiment with

Two quotes from others

Three questions to dig deeper

Four lines of poetry for the point

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

Your IRA, made to order

Choose where and when you want to retire, and a Betterment IRA can help make your money hustle all the way there.

One tool to experiment with:

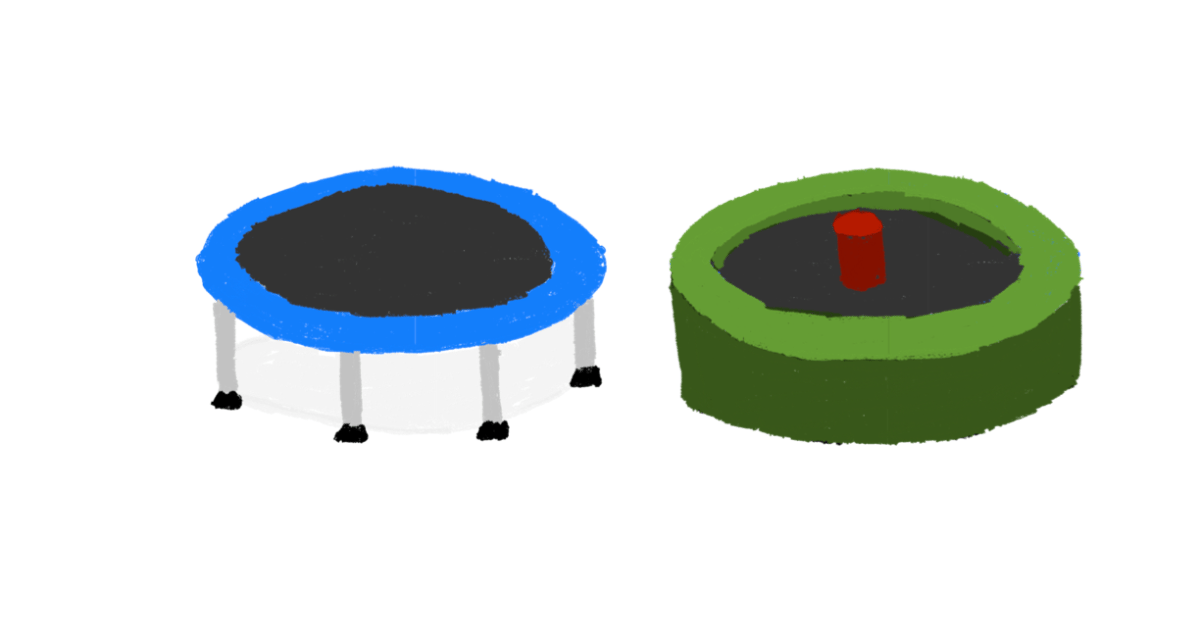

Trampolines and Land Mines

There’s a sign on the gate that guards a field you want to enter. On it, printed in bold black letters, “DANGER.” You’ve been warned. This field carries trampolines and land mines.

Each time you get the itch to make a big trade, beware. That next tempting trade might be a trampoline, or it might be a land mine.

There’s an allure to pushing our chips on an idea. We see these opportunities as springy trampolines for our portfolios. If your idea hits you can stand to make a small fortune in a short amount of time. It’s that potential that draws us in.

What we see is the upside. We miss the risk that sits below. And that’s this: Some of those apparent trampolines are land mines, lethal to your portfolio. Step on one and it can take you months or years to recover your losses.

If we save $100/month, the prospect of making $1,200 on a single trade is significant. One trade can eclipse an entire year of saving. That upside hooks us. But what if we missed, or worse, what if we were right and an unforeseen crisis pushed markets the wrong way?

That’s the wild thing. You can be absolutely right and still lose a fortune. Markets can stay irrational for an irrational amount of time. And if your idea is right, yet you lose money, it does not matter.

That’s the hidden danger of a trampoline hunt.

It’s nearly impossible to tell the two apart. So if land mines can’t be distinguished from trampolines, what’s the strategy? How can we navigate these fields?

Risk avoidance.

For a situation where risk of ruin is present, risk avoidance is required. And it’s a simple implication. All that is required to avoid a land mine is to walk through another field.

The safe field that’s free of land mines is the long-term oriented investing field. The one where we aren’t looking for quick hits.

It takes fortitude to walk the other way. Once you take a few losses from footing a land mine instead of a trampoline, it’s hard to get out of the field. Instead of taking the rational turn and heading home, you double down.

Your revised filter is to find the idea that helps you get back to where you were — to recoup your losses, then be done. Have you ever told yourself this? I have. “Once I’m back to my cost, I will get out and stay away.”

But things don’t often go back to the place we want them to. So this is a dangerously deceptive line of justification and negotiation.

you never know what rests below

Two quotes on uniqueness

Be different, be yourself. We often purchase conformity, and it costs us dearly; our time and money.

“The most important kind of freedom is to be what you really are. You trade in your reality for a role. You trade in your sense for an act. You give up your ability to feel, and in exchange, put on a mask. There can’t be any large-scale revolution until there’s a personal revolution, on an individual level. It’s got to happen inside first.”

“To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment.”

Three questions on past mistakes:

Mistakes are meant as lessons, but instead of parting ways with the shame and hanging onto the lesson, we sometimes keep the mistake shame around like an old ghost.

What past money mistakes do I keep beating myself up on?

What triggers these thoughts?

How would I encourage a friend if they made these mistakes — why is it that I treat myself differently?

Which question stuck with you? Questions like these are spotlights for the mind. Reply to this email and let me know which one shined light on a previously dark cave.

Four lines of poetry for the point:

Walking in a field, you’ve seen the signs of danger;

Trampolines and land mines, real risk is no stranger.

You hit it big on a fancy trade, so you tried again,

But then you tripped a land mine, and brought your dollars to an end.

Contact Me:

Content ideas, questions? Reply to this email or reach out to me at [email protected]

Disclaimer: This is not investment advice. These weekly posts represent my simple thoughts, a few quotes, and some questions — for educational purposes only.

Reply